If all 20 stock holdings of 100-share positions could mimicked by $1,290 cost, then total equity option investment would be only $25,800, leaving $174,200 in cash. Reasonable diversification requires 20 holdings of $10,000 each 102 shares of OXY costs $9,940 ($102 * $97.45) One OXY $90 LEAP call for $1,290 gives virtually same profit potential of 102 shares for 87% less cost than $9,940. Portfolio Construction $200,000 Equity Portfolio. Profit if Stock Rises to $110 at Expiration: $20/$ = 55.0%, which is 42.1 percentage points higher than stock return (12.9%)! Delta increases towards 100% by expiration. Specific Trade Example (April 29th) Stock: Occidental Petroleum (NYSE: OXY) at $97.45 Call Option: January 2016 $90 Call at $12.90 (expires in 625 days).

Sell Low-Probability Fear Out-of-the-money put options Buy High-Probability Growth In-the-money call options Sell Low Probability Greed Out-of-the-money call options Seasonal tendencies can be based on weather events (temperature, precipitation, planting cycle), spending surges (holiday and back-to-school shopping, end of government fiscal years, tax refunds), new-product announcements at industry conferences, or financial events (quarterly earnings reports, dividend hikes, and regulatory approvals.).ĩ 10-Year Stock Seasonality Navigator Frequency Strengthġ1 Easy Strategy: Buy Long-Term Calls (LEAPS)ġ2 Options LEAP Call Strategy Buy High-Probability Growth For example, consumer-related stocks (e.g., food, drugs, beer, leisure, utilities, media, and retail) outperform the overall market between May 1st and October 31st and manufacturing and production stocks (e.g., consumer durables, chemicals, construction, mining, steel) outperform between November 1st and April 30th. Some stocks tend to go up consistently at certain times in the year.

“Seasonality” refers to particular time frames during the calendar year when a company’s stock price is influenced by recurring forces that produce a consistent price direction – either bullish or bearish. Out-of-the-money put options Buy High-Probability Growth In-the-money call options Sell Low Probability Greed Out-of-the-money call optionsĨ OFI’s 10-Year Stock Seasonality Navigator But the S&P 500 remains comfortably above its uptrending 10-month moving average, so the Ivy Portfolio market-timing system continues to flash a “fully invested” signal. The Investor Intelligence bull/bear ratio has been above 3 for most of the past five months, which is longer than any time since the 1980s. University of Michigan finance professor Nejat Seyhun: insider selling is “as pessimistic as I’ve ever seen over the last 25 years.” More pessimistic than in 2007 (before 37% bear market in 2008) and more pessimistic than in 2011 (before 20% market correction). Nasdaq/NSYE relative strength dropped decisively below its 10-week moving average for the first time since late September 2012.

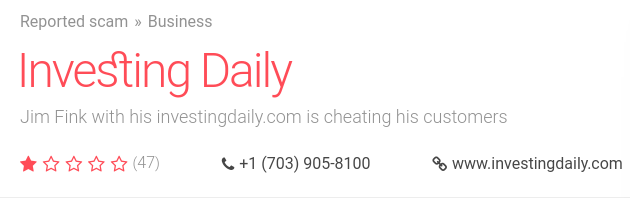

#Jim fink investing crack

Present level is associated with projected annual total returns on the S&P 500 of just over 1.8% annually.”ĥ Other Warning Signs High-flying momentum stocks in the Internet (e.g., GOOG, FB, PCLN, NFLX) and biotechnology (e.g., ALXN, REGN, CELG, GILD) sectors have already begun to crack with steep corrections. John Hussman: “ since the 1940’s, the ratio of equity market value to GDP has demonstrated a 90% correlation with subsequent 10-year total returns on the S&P 500. stocks is $19.8 trillion Since 1970, only three times that market cap has equaled GDP: (148%) – Nasdaq lost 78% 2007 (111%) – S&P 500 lost 56% 2014 (118%) - ? Economics Ph.D. Warren Buffett: The percentage of total market cap relative to the US GDP is “probably the best single measure of where valuations stand at any given moment.” US GDP is $16.8 trillion and total market cap of U.S.

Robert Shiller’s cyclically-adjusted 10-year P/E ratio is currently 28.4 vs long-term average: 81% overvalued. Right now, stock market is 75% overvalued, right near the overvaluation peak prior to previous bear markets. Yale economics professor James Tobin Q ratio: market price of stock divided by asset replacement cost Similar to book value, but better because market values, not accounting values Andrew Smithers (U.K.) maintains Q ratio: Stock market is overvalued whenever Q ratio is above its long-term average.

#Jim fink investing how to

1 The Options Miracle System: How to Generate 30% Annualized Returns in a Stagnant Market With Limited Risk Jim Fink The Wealth Summit May 2014Ģ Chief Investment Strategist, Jim Fink’s Options for Income

0 kommentar(er)

0 kommentar(er)