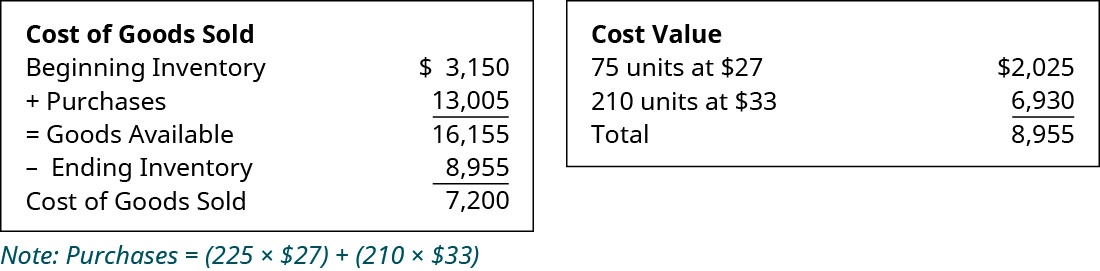

Your COGS will depend on your product and your business. Finally, multiply the result by 100 to arrive at your gross profit margin (which is. In other words, these are costs you would not have if you had not made any sales. Then divide that top number (net sales minus COGS) by your net sales. 'COGS' represents only the direct costs that go into each product or service you sold. Fixed costs are $10 million so the company has to sell 500,000 units to break even ($10 million / $20 per unit = 500,000). EBITDA (earnings before interest, taxes, depreciation, and amortization) is revenue minus the COGS mentioned above as well as operating expenses and selling, general, and administrative expenses. The formula for gross profit is revenue minus the cost of goods sold, or COGS. In order to perform this analysis, calculate the contribution margin per unit, then divide the fixed costs by this number and you will know how many units you have to sell to break even.īuilding on the above example, suppose that the company sold 1 million units. More than likely, if this company grew revenue to 20M, gross profit margin would remain close to 80 and COGS would be 4M. The formula for this calculation is revenue minus the cost of goods sold. If a company has 10M of revenue and 2M of COGS, the gross profit is 8M. To learn more, check out our Financial Analysis course. When you calculate gross profit margin at regular intervals and look at your. It can be important to perform a breakeven analysis to determine how many units need to be sold, and at what price, in order for a company to break even.

Companies may have significant fixed costs that need to be factored in. The contribution margin is not necessarily a good indication of economic benefit. The gross margin result is typically multiplied by 100 to show the figure. The fixed costs of $10 million are not included in the formula, however, it is important to make sure the CM dollars are greater than the fixed costs, otherwise, the company is not profitable. The gross profit margin is calculated by taking total revenue minus the COGS and dividing the difference by total revenue. Example Calculation of Contribution Margin RatioĬM ratio = (total revenue – cost of goods sold – any other variable expenses) / total revenueĪ company has revenues of $50 million, the cost of goods sold is $20 million, marketing is $5 million, product delivery fees are $5 million, and fixed costs are $10 million.Ĭontribution margin dollars = $50M – $20M – $5M – $5M = $20 millionĬontribution margin ratio = $20M / $50M = 40% In short, your marketing cost is subtracted. Here is the formula for contribution margin ratio (CM ratio): The following are examples of operating expenses, except: Select one: a. Your gross profit is the revenue you earned through your sales minus the cost of goods minus the marketing expenses. It represents the marginal benefit of producing one more unit. The contribution margin ratio (CM ratio) of a business is equal to its revenue less all variable costs, divided by its revenue. Updated MaContribution Margin Ratio Formula

0 kommentar(er)

0 kommentar(er)